Tesco results – How bad is it? Part 1 – Sir Terry Leahy

Steve Dresser

Founder of Grocery Insight & retail influencer

"The man supermarket CEO's turn to" - BBC"

You have to feel for Philip Clarke, taking over a mother ship that had experienced rapid growth in all channels, blazed a trail for internet shopping, loyalty and a formidable top team meant that he had big shoes to fill. Winning in the first place is easier than continuing to win and consistency is very hard to achieve, Sir Terry did that, growing the business year on year.

What quickly became apparent to retail watchers was that growth was being funded by cuts to staffing, store refits and maintenance. The quickest way to boost profits is to cut costs, as improving the sales line takes time and from every £1 taken at the tills, c. 6p (based on trading margin) is profit, so profits don’t show an immediate improvement.

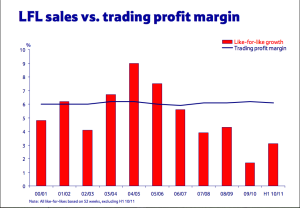

Sir Terry grew the UK core admirably, look at the prelims from 06/07 – like for like sales growth of 5.6% with volume alone up 5%, the interims from 07/08 show 2.6% rise in volume, with like for likes up 3.5%. 07/08 prelims show another rise in volume (up 2%) with like for like sales up 3.9%. Growth upon growth.

The margin had been held steady at 5.8% but April ’08 saw an increase in the trading margin to 6.1%, there has always been a focus on cutting costs at Tesco, April ’08 saw the first mention of ‘step change’ and indeed coincided with the Fresh & Easy launch which naturally contributed losses throughout its time as a Tesco brand overseas.

Fast forward to September ’08 and like for likes continued to improve, with a 3.7% rise. Margin was back down slightly to 5.9%, a lot of chatter about the foreign escapades and what appears like delusion (with hindsight) about the prospects of Fresh & Easy.

2008 saw the first rise of the discounters and this was happily quelled by Tesco with a two pronged attack both pushing Finest (at the top end) and then introducing mid tier / low tier private label Aldi-esque products with price comparisons on shelf. Paul Foley (Aldi MD at the time) said it was the best piece of marketing Aldi ever did, albeit via Tesco. More step change mentions too….

April ’09 saw a LfL sales rise of 4.3% with a 2.1% rise for the last 7 weeks of the financial year, so a slowdown in sales rates and the margin crept up again to 6.2%. This presentation was notable for the ‘investment in the shopping trip’ which was funded by £540m of step change savings.

A step change is something at HQ identified by the legion of Six sigma, Toyota principle experts who identify duplicated tasks that add no value and eliminate them. The fact that car manufacturing is highly automated, highly process driven where each cycle of production is timed and documented thus in no way at all like the fluid landscape of food retail is not important.

Lean principles have some value, certainly bringing standardised (one of the 6 S’) process to the operation of departments is a good thing. However each transaction may be 5 seconds less because the cashier isn’t prompted to ask for cashback, multiply that by the number of transactions within Tesco in a day = a huge saving.

The problem is, there are numerous examples of step changes that simply don’t work as intended, or worse still, don’t work in every format / store but are rolled out anyway. No lean manual / time & motion study in the world accounts for ‘customer service’ and the old dear who likes to have a chat, or the old lady who has a colleague wheel her around to do her shopping. That’s where it goes wrong.

Oct ’09 saw more talk of the foreign markets and how they perform well (as is the case previous years) but there was an acceptance that things were tough in Central Europe with Ireland and Japan starting to have major issues, naturally the US continued to lose money.

The UK margin was improved by 20 basis points however, pushing up to 6.4%(?) and it was the era of double clubcard points too. Interestingly there was no overview of sales in this presentation (usually a chart was produced) – UK Q1 was 4.3% up and UK Q3 saw a rise in sales of 2.8% and good volume growth.

April ’10 saw LfL sales rise by 3.2% fuelled by volume growth and an increased investment in the shopping trip, £550m was targeted as a cost saving this year, to further improve the shopping trip. An £800m target was set globally via step changes. An interesting slide spoke about ‘excellent potential in non food’ and ‘a new space pipeline to drive 3-4% of new sales’.

Ireland was discussed (a major victim of the discounters) and they were showing strong like for like growth after a 12,000 lines were reduced in price.

Oct’10 saw LfL slow down notably, down to 1.2%, at the time outperforming the industry but it was notable that the industry was starting to slow down. The cost saving kept coming though; the £550m step change was talked about again too.

This presentation was notable in that it was the first time Philip Clarke appeared in front of the city, he was introduced at CEO designate and ran through the international business of which he was responsible for at the time. A 6.1% sales growth in Ireland was notable, showing that the price cuts had paid off.

April 2011 saw Philip Clarke appear in front of the city for the first time as Group CEO, he set out to have a dedicated UK board along with a pledge to keep the ‘UK growing and strong’. Volumes were noted to be falling, trading tougher and non food had flipped from showing growth to being an issue with demand faltering from November ’10.

Interestingly, basic operating standards were flagged as being ‘fine’, although the business needed better innovation and execution. There was talk of the multi channel world as there needed to be more work from Tesco getting everything online, click / collect etc.

He also set out what to expect from him as a CEO – ‘out in the stores’, ‘willing to engage’, ‘willing to discuss the bad things as well as good’ with ‘focus’, ‘energy’ and ‘intensity’. All about performance. Margin remained stable at 6.1%.

A weekly email covering the latest events in the industry; such as Tesco store operations, store visits or new promotional packages are all covered. Please visit our emailed retail insight page for further information.

Grocery Insight provide market insight on the UK sector with a focus on individual retailers such as Tesco. This insight is useful to various stakeholders and due to my store based focus. Insight can be delivered to suppliers to focus on growth opportunities, analysts and investors to assess the business performance and long term outlook and retailers themselves to assess best practice.